Herein, I review 2022 bicycle industry patents. If you want a sneak peek at the future of where bicycle technology is headed, consider patent applications. Applications for utility patents publish (with some exceptions) 18 months after their filing date* – often before news of a related product is publically released . Patent filings also may give an indication of the resources each company has been putting into R&D over the past several years.

While I’ve written an annual summary of issued industry patents in the past, perusing the year’s published patent applications may be more insightful, as the later become publically visible earlier, and thus may be the first look at technology a company seeks to protect. Of course, inventions shown in patent applications could represent early stage R&D efforts that may not continue be pursued into saleable products (or even issued patents). I’ve also noted issued design patents – these do not publish until issuance.

A few big bike brands may dominate the floorspace of US retailers, but those are not the companies that file and own most of the industry’s patents. It’s primarily component manufacturers that pioneer new bike tech, and therefore have the greatest incentive to stake intellectual property claims. Areas like drivetrains, brakes, suspension, and ebike workings are where the big changes happen, and where a few established suppliers compete for market share. Herewith, an overview of 2022 bicycle industry patents — focused on US utility patent applications published in 2022.

Shimano: 69 (also 16 for fishing technology) (0 design patents)

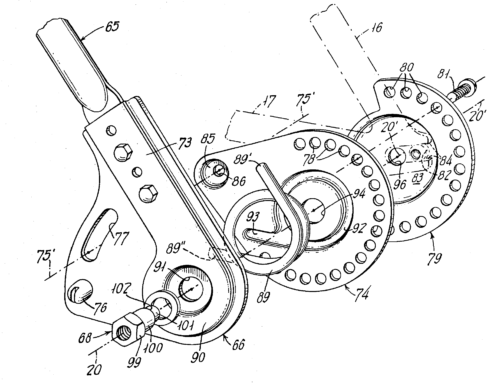

Being the big kid on the block as a component supplier also means Shimano tops the ranks in 2022 bicycle industry patents – for yet another year. As expected, inventions relate to derailleurs, brakes, pedals, sprocket assemblies, etc. – all areas where Shimano has been a leader for decades. But they have plenty of patent filings for products they’re not selling. Or yet selling. Like an electronically controlled dropper seatpost, and a wirelessly controlled shock fork. Ebike related tech is covered with inventions ranging from communication systems to battery mountings, as the company continues its push against rival supplier Bosch. And for new versions of old designs, Shimano looks to protect a power-generating rear hub, as well as a derailleur with three pulleys. Anti-lock braking has long been a holy grail in bicycle engineering, and Shimano shows a disc brake set-up that uses magnetic or optical sensors monitor wheel rotation.

SRAM: 39 (5 design patents)

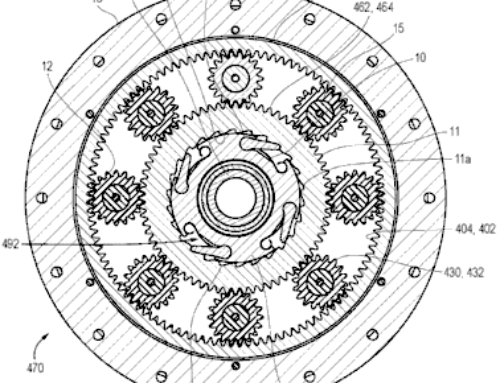

The Chicago company remains very active in patent filings for technology that spans its many brands including, SRAM, Zipp, Avid, Truvative, Rockshox, and Quarq – with current patents filed under the SRAM corporate name, regardless of what label sells the related product. As expected, SRAM’s patent filings span the full range of products they sell, from drivetrain parts to suspension to braking systems. Derailleurs get lots of attention, including one that has a built-in generator for charging a shifting battery or supercapacitor. Another filing shows a rear derailleur battery housed in the rear wheel’s thru-axle. SRAM and also stakes claims for a linkage suspension fork, that looks aimed toward gravel riding. Also, in Feb 2021, SRAM acquired Time and its related pedal patents, but no new pedal-related filings were found – so no reveals of related progress with product development. Unlike their competitors, SRAM makes use of design patents, with two for rims and three for brake rotors issuing in 2022.

Campagnolo: 8 (0 design patents)

The iconic Italian company continued its recent trend of filing fewer patent applications each year. 2020 saw 7 filings, 2021 marked 11, with 2022 settling in at 8 – all well down from the 32 applications in both 2018 and 2019. Campy is pursuing wheel inventions in three different filings, and a carrier for the largest two cogs of a cassette in another application. Temperature compensation for power meter strain gauges gets another application. Surprisingly, or perhaps not, is a single filing for a motorized rear hub – first Ferrari announces an SUV, now ebike tech from Campagnolo. Several derailleur-related filings include both cable and motorized actuation. The company has received numerous patents over the last decade for wireless shifting, but there’s nothing new revealed for the year. Campagnolo’s 2022 patent work gives little away as to where they’re headed, other than their patent budget having shrunk – which suggests their R&D work has as well.

Specialized: 12 (4 design patents)

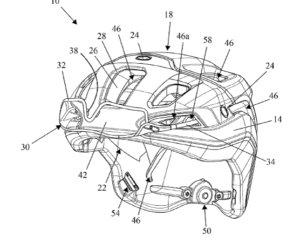

Among the big four US bike brands, Specialized continues to lead the way in patent work by a large margin. The company’s filings span a wide range of inventions that include both bicycles and accessories. Three filings are directed to suspension – but surprisingly, all are for a linkage suspension fork, a configuration that’s been out of fashion for decades. Specialized also looks to protect a shoe lacing system with rotary dials, a saddle with different stiffness regions, a helmet fit system, and a display screen that mounts a top tube to show ebike battery levels. Even Specialized’s ubiquitous water bottles could have company, in the form of a spill-proof lid for a coffee-style beverage container.

Bosch: 1387, dozens bicycle-related (0 design patents)

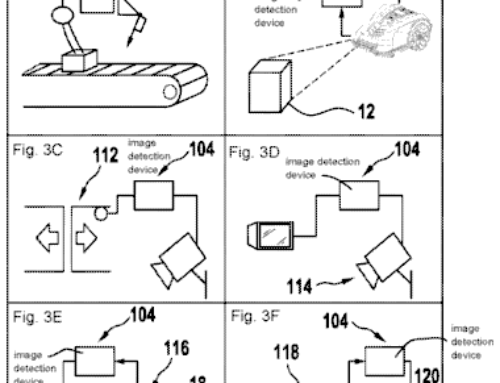

Technology giant Bosch is of course a major supplier of ebike power systems. But plucking the ebike-only tech of the company’s 1387 filings is extremely tough. The company produces a huge range of technology as used both in their own brand of complete finished products (e.g. Bosch home appliances) as well as components made for other manufacturers – like ebike motors. Bosch also makes automobile sensor systems for crash avoidance with cyclists and pedestrians. Suffice to say, Bosch has lots in the pipeline, from patent filings from basic designs for mounting an ebike battery to a frame, to one titled: DYNAMIC SPATIOTEMPORAL BEAMFORMING.

Yamaha: Approximately 5 bicycle-related (0 design patents)

Yamaha’s patent filings number in the hundreds each year, and for 2022 about five of those are directed towards bicycles. Or ebikes more specifically, for which Yamaha has long-term designs of being a player in the market. One filing shows an ebike display (for battery level, etc) that mounts in place of a stem cap. Other inventions claim sensors for a bicycle’s speed or applied torque to manage power delivery and battery life. A wildcard invention: a system for a virtual cycling in which an indoor rider sees in real-time what an outdoor rider is experiencing, including scenery, as well as using slope measurements from the outdoor rider to control the resistance of the indoor trainer.

Canyon: 7 (0 design patents)

The German-based brand continues their push of consumer-direct-only sales in the US, and is investing in protecting its inventions. Consider that in 2022 Canyon had more than three times as many utility patent filings as Trek, Giant, and Cannondale combined. Keeping with the consumer-direct model, two of their patent filings are for boxes for shipping bikes, including an ebike specific carton. Four other filings claim ebike technology, including a battery assembly, as well as a frame tube configured to hold a battery.

Fox Racing: 21 Bicycle Related (0 design patents)

The company is well-known for its suspension technology – used both on bicycles and motorized vehicles. As such, some of their inventions may be applicable to human and motor powered rigs alike. At least 21 of Fox’s 27 total US patent applications last year include bicycle in the description, with 18 of those related to suspension. Inventions cover shock assemblies, damper technology like adjusters and valves, many with electronic sensing features. Fox also makes claims for ebike tech that uses different component sensors and ride data (like GPS) to manage battery life. Fox continues pursuing new patents on “Methods and Apparatus for Virtual Competition” that’s directed to mountain bike racing and ski racing. The company already has three issued patents from the same parent application that dates back to 2008 – but with no apparent movement towards commercializing the esports inventions.

Tektro: 6 (0 design patents)

Tektro made its name with brakes, but 2022 patent publications show that the Taiwanese company is on a push to develop electronic shifting systems. One filing shows brake/shift levers for front and rear motorized derailleurs, with a control/junction box that can mount to the frame or handlebar stem. Another application shows an electronic front derailleur with its own integrated battery. These follow the 13 patent filings seen in 2021 that showed wirelessly controlled rear derailleurs, systems for pairing wireless components together, low battery management protocols, and more. Tektro’s first patent application for derailleurs and shifting was filed way back in 2015, with a steady stream ever since – suggesting they’re setting-up to be more than a brake supplier.

Others:

For 2022 bicycle industry patents, Giant showed only two US utility patent applications for 2022, with no design patents granted. That’s down from nine total in 2021, which spanned everything from tools to shoes to composite frames. Trek had no US utility patent filings, with two design patents issued. They’ve bottomed-out after five filings for 2021, eight for 2020, and 11 for 2019. Finally, laterne rouge Cannondale again showed no recent US patent filings, and ditto for its (former) parent company Dorel Sports. PON Holding acquired Dorel in 2021, giving it ownership of numerous bike brands, but PON shows only three bicycle-related patent applications in the last 10 years.

*Patent applications published in 2022 were submitted to a patent office (US or foreign) between July 2020 and June 2021. I use the term “filings in 2022” to describe what first became publicly visible in 2022, though they were actually submitted up to 18 months earlier.

This article was first published in Bicycle Retailer and Industry News